A Trusted Advisor to handle your accounting and taxes

Williams Kunkel

/

December 31, 2024

/

In The Richest Man in Babylon, these principles outlined emphasize the importance of having trusted financial advisors to manage wealth.(A Trusted Advisor to handle your accounting and taxes). 1. Accountants Help You Follow the Law (The Fifth Law of Gold) 2. Expert Management of Financial Records (The Third Law of Gold)... Read more

Tax Planning for Realtors: Texas Real Estate Lawsuit

Williams Kunkel

/

November 28, 2023

/

Tax Planning for Realtors: Texas Real Estate Lawsuit: Texas real estate associations and a group of home brokers face new claims that they artificially inflated sales commissions in the state. Moreover, this opens another front in litigation over real estate commissions after a $1.8 billion verdict against the residential brokerage... Read more

Top 10 Strategies for Smart Tax Planning: Save Money When Filing 2023 Taxes

Williams Kunkel

/

February 28, 2024

/

Are you ready to optimize your tax planning for 2023 and maximize your savings? In this comprehensive guide, we’ll unveil 10 savvy strategies endorsed by CPAs and accountants to help you save money when filing your taxes. From smart deductions to proactive planning, empower yourself with the knowledge to navigate... Read more

Maximize Your Savings: Last-Minute Tax Tips for Business Owners

Williams Kunkel

/

March 28, 2024

/

As the tax season draws near, we are scrambling to optimize financial strategies to minimize tax liabilities and maximize savings. In this blog post, we’ll explore some last-minute tax-saving tips tailored specifically for business owners. This will help you keep more of your hard-earned money in your pocket. (Maximize Your... Read more

Saving on Taxes After Tax Day: A Guide For Business Owners

Williams Kunkel

/

April 30, 2024

/

For business owners, Tax Day isn’t just a deadline. Quite the opposite, it’s an opportunity to reflect on financial health and plan for the future. That said, now that Tax Day has passed, let’s shift gears and focus on saving money/maximizing profits for the rest of the year. (Saving on... Read more

Tax Planning CPA: Tax Tips to Consider During the Summer

Williams Kunkel

/

May 31, 2024

/

Summer is often synonymous with vacations, relaxation, and enjoying the great outdoors. However, it’s also an excellent time to get a head start on your tax planning. By taking some proactive steps now, you can reduce your stress come tax season and potentially save money. Here are some key tax... Read more

Dallas Texas CPAs: Make Your Money Last In Retirement, Part 2

Williams Kunkel

/

November 8, 2019

/

,

Things will get more expensive as you age. Inflation will erode your buying power, putting pressure on your spending. Having a plan for inflation will help you not run out of money in retirement. (Dallas Texas CPAs: Make Your Money Last In Retirement, Part 2) 1. Make Healthier Choices Being... Read more

DFW Tax Advisors: Rest of the Year Tax Tips

Williams Kunkel

/

September 12, 2019

/

If there’s one thing we can generally agree on, it’s that taxes are a major pain. Nobody likes dealing with them, and nobody enjoys filing them. But if you follow these tips, you may find that you not only pay the IRS less money, but will also have an easier... Read more

DFW Tax Strategy: How Small Businesses Can Hold Onto Money

Williams Kunkel

/

December 27, 2018

/

,

Most small biz owners don’t have backgrounds in finance. However, that doesn’t mean they can afford to avoid the administrative tasks that come with running a company. We face massive variation in the cost of goods and services. A $100 million agency that sends $90 million out the door on... Read more

Flower Mound CPA: Real Estate Professional Tax Tips

Williams Kunkel

/

February 28, 2019

/

,

Whether you’re preparing your taxes on your own as real estate professional or having a tax strategist CPA help you, here are some tips: Don’t forget your mileage. Many real estate agents leave money on the table when it comes to their mileage. Depending on where you work on a... Read more

Flower Mound Tax: New Small Business Tax Code

Williams Kunkel

/

April 17, 2018

/

Tuesday is Tax Day, the last day to file income taxes for the 2017 income tax season. The old tax code was replaced by the tax cut legislation passed by Congressional Republicans late last year. This seems like a good opportunity to reiterate the tax changes for the country’s 29... Read more

Real Estate CPA: How Investing Can Help Save You Taxes

Williams Kunkel

/

September 26, 2018

/

The Tax Cuts and Jobs Act has changed our finances and the profitability of investments. Much of the press coverage around the new rules has been on its drawbacks. However, some positive financial opportunities exist for those who educate themselves and act on new breaks. The new tax law both... Read more

DFW Tax Help: Small Business Year End Tips

Williams Kunkel

/

November 14, 2017

/

Let’s take a look at where your small business stands as the year comes to an end. These small business year end tips can help you make sure you’re in good shape financially as you head into the new year. DFW Tax Help: Small Business Year End Tips Take Some... Read more

Tax Time T.V. Giveaway!

Williams Kunkel

/

April 7, 2017

/

We’re giving away this awesome 55” 4K Ultra HD Vizio TV– valued over $600– to ONE lucky winner! You MUST COMMENT ” DFW CPA” on our Facebook post , and SHARE the post on your own page. The winner will be chosen by a random drawing on April 19, 2017... Read more

Small Business Consulting: Restore Your Energy After Taxes

Williams Kunkel

/

April 25, 2017

/

Looking for a few tips to revitalize your personal energy after the tax season is over and get ready for the summer? Some of these small business consulting tips are so easy and simple you might think they won’t do anything for you. As you read, check to see which ones... Read more

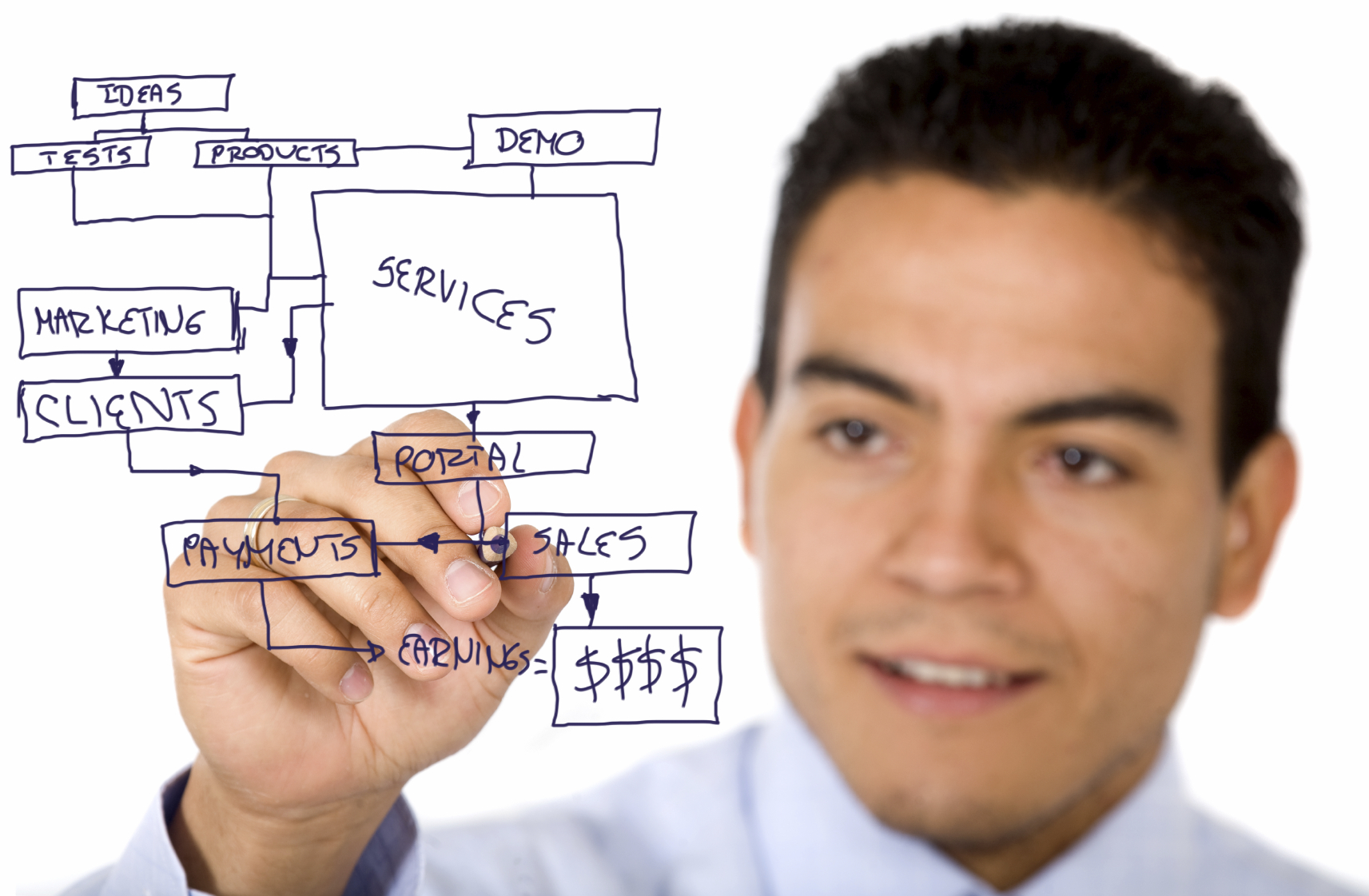

What’s Your Business’s Purpose?

Williams Kunkel

/

October 25, 2016

/

,

Defining Your Purpose If you don’t know what is is, your customers won’t either. Also, you won’t be able to tell your customers why they should choose you over your competitors. Surely when you decided to start your business you were inspired. Was it to provide a service or product better,... Read more

Being a Parent Lowers Your Taxes

Williams Kunkel

/

October 27, 2016

/

,

If you are a parent, you can lower your tax burden significantly. Eight different tax credits and deductions are out there that can help lower your tax burden: Dependents In most cases, a child can be claimed as a dependent in the year they were born. Be sure as... Read more

Some IRS Changes for 2017

Williams Kunkel

/

November 3, 2016

/

,

If you’re a business owner, don’t forget about the date January 31, 2017, the new due date for filing forms W-2. Under a new law, the Protecting Americans from Tax Hikes (PATH) Act, enacted last December, the new filing deadline for employers to submit forms W-2 to the Social Security Administration,... Read more

An Intro to Trump’s Tax Plan

Williams Kunkel

/

November 10, 2016

/

,

What do you know about president-elect Donald Trump’s tax plan? For starters, he has proposed the largest tax cuts since Ronald Reagan. If Trump were to get everything he has proposed from a Republican-controlled Congress, a taxpayer who makes between $48,000 to $83,000 a year would save about $1,000 under... Read more

How a CPA Can Boost Your Small Business

Williams Kunkel

/

November 17, 2016

/

,

If you’re starting a small business on a fixed budget, you’ve probably spent some time trying to figure out where you can cut costs and do more on your own in order to stretch the funds you have available. One area where you may consider doing it yourself instead of farming... Read more

Start With a 4-Figure Income

Williams Kunkel

/

December 1, 2016

/

,

Don’t worry about chasing the dream of having a 7 figure income. Start more reasonably. Try to focus on building a 4 figure income first. To Be Clear Yeah, 4 figures might not be a huge amount of money to you. You can’t buy a mansion with it. But 4... Read more

New IRS Tool to View Tax Balance

Williams Kunkel

/

December 8, 2016

/

,

The IRS has announced the launch of a new online tool to help taxpayers. This new IRS.gov tool allows taxpayers to view their tax account balance online. The balance includes any amount owed for tax, as well as penalties and interest for each tax year. Once you look at your balance, you... Read more

Tax Moves to Make Before New Year

Williams Kunkel

/

December 14, 2016

/

,

As the end of the year gets closer, unfortunately it’s time to think about taxes and make some moves. The tax season may seem far off, but this is the time of year to get the ball rolling. Let’s look at some easy steps to take that could help you... Read more

Four Ways to Grow Your Business

Williams Kunkel

/

January 5, 2017

/

,

Four Roads to a Thriving Business According to most people, there are only four ways to grow your business: Increase the number of customers Get them coming back more often Increase the average spend Improve the effectiveness of every business process For instance, a local art gallery worked with their... Read more