Year-End Tax Planning Tips

Williams Kunkel

/

November 10, 2015

/

,

Got your year-end tax planning underway for December 31, 2015? WE UNDERSTAND that year-end can be a drudge because it means making sure your business accounts are up to date and in order. But don’t leave it until the last minute. No decision, or rushed decisions, can lead to the... Read more

Time to Check Tax Withholding

Williams Kunkel

/

November 17, 2015

/

,

Income tax is often withheld from wages and other types of income such as pensions, bonuses, commissions and gambling winnings. Ideally, taxpayers should try to match their withholding with their actual tax liability. If not enough tax is withheld, they will owe tax at the end of the year and... Read more

Choosing the Right Tax Professional

Williams Kunkel

/

November 19, 2015

/

,

Choosing a return preparer before the next tax season allows you more time to consider the appropriate options. Doing it early also gives you the chance to find and talk with prospective tax preparers rather than during tax season when they’re most busy. Furthermore, it enables taxpayers to do some... Read more

11 Tips for Year-End Tax Planning

Williams Kunkel

/

November 24, 2015

/

,

With the end of the year approaching, it’s time for strategic moves to lower your 2015 tax bill. Strategy: Prepay deductible expenditures If you itemize deductions, accelerating some deductible expenditures into this year to produce higher 2015 write-offs makes sense — if you expect to be in the same or... Read more

2015 Tax Provisions for Individuals

Williams Kunkel

/

December 15, 2015

/

,

From tax credits and educational expenses to the AMT, many of the tax provisions affecting individuals for 2015 were related to the signing of the American Taxpayer Relief Act (ATRA) in 2012… …tax provisions that were modified, made permanent, or extended. With that in mind, here’s what individuals and families... Read more

6 Self-Employed Tax Tips

Williams Kunkel

/

January 26, 2016

/

,

Early in a new year is often the time when would-be entrepreneurs think about going into business for themselves. Self-employment can be a terrific opportunity to be your own boss and do something you love to do. Being your own business also brings with it a special set of tax... Read more

Five Key Tax Tips for New Businesses

Williams Kunkel

/

January 22, 2016

/

,

If you start a business, one key to success is to know about your federal tax obligations. You may need to know not only about income taxes but also about payroll taxes. Here are five key tax tips for new businesses that can help get off to a good start:... Read more

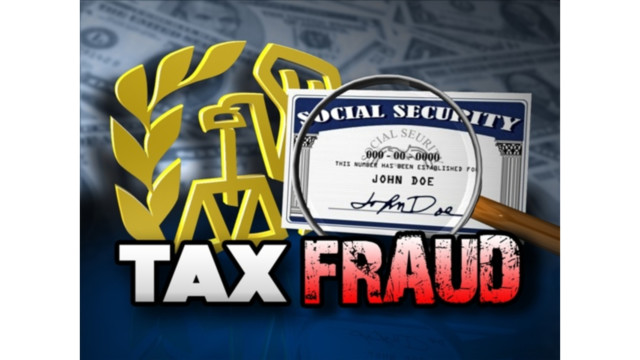

How to Prevent Income Tax Refund Fraud

Williams Kunkel

/

January 19, 2016

/

,

How do you know if someone has filed a tax return using your Social Security number to commit income tax refund fraud? And what do you do then? This is happening all the time—the latest General Accounting Office (GAO) report says that IRS paid out over $5.8 billion in fraudulent... Read more

2016 Tax Changes: A Checklist

Williams Kunkel

/

January 12, 2016

/

,

Welcome, 2016! As the New Year rolls around, it’s always a sure bet that there will be changes to current tax law and 2016 is no different. From health savings accounts to retirement contributions and standard deductions, here’s a checklist of tax changes to help you plan the year ahead.... Read more

3 Common Entrepreneur Mistakes

Williams Kunkel

/

January 14, 2016

/

,

When it comes to starting a new business, most people focus on how they will win and achieve the American dream. But success isn’t something most new businesses experience. It’s important to be aware of entrepreneur mistakes. “The painful truth is that the majority of first-time entrepreneurs who launch a... Read more

Year-End Tax Planning for the Individual

Williams Kunkel

/

November 5, 2015

/

,

,

Tax planning for the year ahead presents similar challenges to last year due to the unknown fate of the numerous tax extenders that expired at the end of 2014. These tax extenders, which include the mortgage insurance premium deduction and the sales tax deduction that allows taxpayers to deduct state... Read more

Is Forgiven Debt Taxable?

Williams Kunkel

/

October 20, 2015

/

,

Generally, debt that is forgiven by a lender is considered taxable income by the IRS and must be included as income on your tax return. Examples include a debt for which you are personally liable such as mortgage debt, credit card debt, and sometimes, student loan debt. When that debt... Read more

How Technology Can Make Bookkeeping Easier

Williams Kunkel

/

June 12, 2015

/

,

Four Ways Technology Can Help With Bookkeeping Does it seem like every time you plan to work on your business’s books , you get distracted? Well, if so, you’re not alone. Tackling the books is one of a business owner’s biggest headaches. Luckily, there’s technology that can help any business... Read more

Williams & Kunkel, CPAs LLP client case study Jesse James Fit

Williams Kunkel

/

March 4, 2015

/

,

,

,

,

,

Just as the before and after images on the website show the amazing transformations of their clients… So too has local business Jesse James Fit in Flower Mound experienced its own metamorphosis. Office Manager Maddie and Administrative Assistant Sally provided some valuable insight on the weight loss center and elite... Read more

6 easy ways to prepare for April 15 next year

Williams Kunkel

/

May 11, 2015

/

,

Many surprises could arise from now until next April 15, including life changes and new tax laws. Right now is the best time to create a system that better organizes your taxes and gets you a head start on next year’s filing. IRS offers some handy advice on how to... Read more

Missed the April 15 tax deadline?

Williams Kunkel

/

May 6, 2015

/

,

,

,

Pay IRS now if you still owe taxes If you still owe taxes and missed the April 15 deadline for filing and payment, you could be incurring interest and late penalties as you read this. File and pay the IRS pronto! If you file your federal tax return late and... Read more

4 things you should ask before hiring a tax preparer

Williams Kunkel

/

April 2, 2015

/

,

With a few weeks left before the April 15 tax filing deadline, it’s that dreaded time of year for those who’d rather give the task of preparing their taxes onto someone else. If you’re one of the 60% of tax filers who plan to hand over your tax affairs to... Read more