Dallas Tax Savings: Best States For Retiring

Williams Kunkel

/

November 14, 2019

/

Even in retirement you’ll likely owe your fair share of taxes. If your retirement savings are kept in a 401(k) or traditional IRA, you’ll generally have to pay income taxes on your withdrawals each year. You’ll also typically be responsible for federal taxes on your Social Security benefits. Depending on what... Read more

Flower Mound CPA Advice: Is an Extension Right for You?

Williams Kunkel

/

March 21, 2017

/

If you can’t pay your taxes by this year’s April 18th deadline, you can always request a 60- to 120-day extension to pay. Don’t forget about asking your local certified public accountant and tax preparation specialist about the benefits. You may still be charged penalties and interest but at a... Read more

The Tax-Savvy Financial Planner

Williams Kunkel

/

August 18, 2016

/

,

If you’re looking for big picture advice that combines tax expertise with the know-how of a financial planner, a CPA might be the best bet outside of tax-preparing season? If you only meet annually during the spring, they may seem too busy to tackle bigger-picture issues. The fall can be a... Read more

Deducting Your Car As a Business Expense

Williams Kunkel

/

September 15, 2016

/

,

Whether you’re self-employed or an employee, if you use a car for business, you get the benefit of tax deductions. There are two choices for claiming deductions: Deduct the actual business-related costs of gas, oil, lubrication, repairs, tires, supplies, parking, tolls, drivers’ salaries, and depreciation. Use the standard mileage deduction... Read more

Four Small Business Mistakes

Williams Kunkel

/

June 21, 2016

/

,

It is only to be expected that business owners make financial mistakes which can jeopardize their dreams. Here are four of the most common small business mistakes and how business owners can avoid them. Failing to plan Few small businesses have a working budget and cash flow forecast which is... Read more

Five Tips to Improve Financial Health

Williams Kunkel

/

March 1, 2016

/

,

If you are having trouble paying your bills, it is important to take action sooner rather than later to improve your financial health. Doing nothing leads to problems in the future, whether it’s a bad credit record or bankruptcy resulting in the loss of assets and even your home. If... Read more

Post-Tax Season Money Tips

Williams Kunkel

/

April 1, 2016

/

,

After tax craziness subsides, spring is an ideal time to take a look at your money management. Here are some post-tax season money tips to help you get your finances in check before summer: 1. Run Your Credit Report Your credit score can impact everything from your mortgage rate to your... Read more

Unfiled Returns and Back Taxes? Read This.

Williams Kunkel

/

January 28, 2016

/

,

We all know the annual ritual: once January rolls around, you gather your tax documents to file your tax returns by the deadline to avoid back taxes and unfiled returns. Sometimes (or maybe the whole time!) you need an extension. And maybe you don’t meet the extended deadline, and now... Read more

2015 Tax Provisions for Individuals

Williams Kunkel

/

December 15, 2015

/

,

From tax credits and educational expenses to the AMT, many of the tax provisions affecting individuals for 2015 were related to the signing of the American Taxpayer Relief Act (ATRA) in 2012… …tax provisions that were modified, made permanent, or extended. With that in mind, here’s what individuals and families... Read more

How to Take a Holiday Break as a Small Business Owner

Williams Kunkel

/

September 17, 2015

/

,

Everyone deserves a break, especially those who work hard trying to a get a business off the ground. A recent survey found that three quarters (76%) of small business owners and entrepreneurs skip their holidays in order to keep their business running smoothly. But while there may never be a... Read more

Improve your business bookkeeping – start with your check book

Williams Kunkel

/

May 21, 2015

/

,

,

Managing good business books isn’t something you should only do as a tax-saving strategy It also gives you peace of mind, ensuring you haven’t mixed up funds or miscoded data entries that require a lot of reversal work or resolution by your accountant. Here are four important reasons why maintaining... Read more

Williams & Kunkel, CPAs LLP client case study Jesse James Fit

Williams Kunkel

/

March 4, 2015

/

,

,

,

,

,

Just as the before and after images on the website show the amazing transformations of their clients… So too has local business Jesse James Fit in Flower Mound experienced its own metamorphosis. Office Manager Maddie and Administrative Assistant Sally provided some valuable insight on the weight loss center and elite... Read more

5 essentials for QuickBooks users

Williams Kunkel

/

April 21, 2015

/

,

Tips for better use of lists, templates, and integrated modules from your Certified QuickBooks Pro Advisors 1. Sense-check your QuickBooks reporting set up If the data presented in your QuickBooks reporting doesn’t make sense or is erroneous, seek our professional help in fine-tuning and correcting it. 2. Properly understand the... Read more

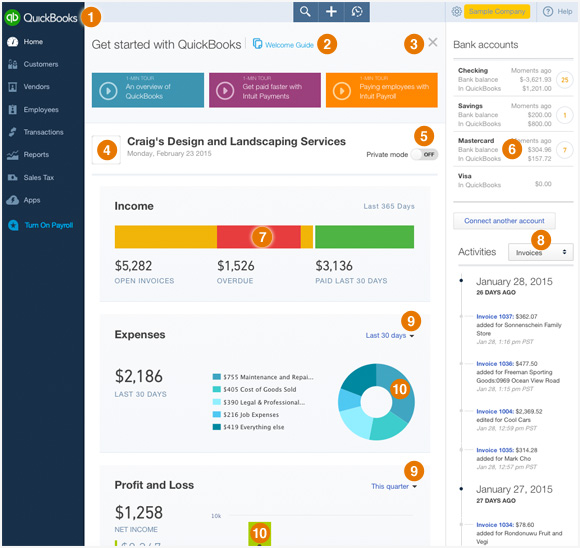

10 handy QuickBooks home page tips

Williams Kunkel

/

April 7, 2015

/

,

You probably have the basics down already, but did you know you can click these 10 things on the QuickBooks home page and be even more productive? QuickBooks logo Why it’s useful: one click takes you back to the home page, no matter where you are. Welcome Guide Why it’s useful:... Read more

Want to make this year’s tax season easier? Get organized

Williams Kunkel

/

March 15, 2015

/

,

,

Tax Tips: How to prepare your business for tax season With the April 15 personal tax deadline looming, businesses have until March 15 to file. Luckily, there are many ways to prepare to get you and your business ready for this tax season. Here’s some tax tips from Williams &... Read more

Accounting can be sexy

Williams Kunkel

/

March 13, 2015

/

,

,

The old system of accounting is really boring. If you are like most small business owners each month you ‘transact’ (making it, buying it and selling it) through a manual system, a spreadsheet, a timesheet, a cash register and/or a receipt or quote book. Then progressively through the month (or... Read more

6 questions every business owner should ask about their accounting system

Williams Kunkel

/

March 5, 2015

/

,

,

Cloud accounting is rapidly becoming the norm for how operators financially manage their businesses. If you haven’t yet made the switch or even taken a look at a cloud accounting solution for your business, then we’ve broken it down into some key questions you should consider: As a small business... Read more