Small Business CPA Advice

Williams Kunkel

/

February 1, 2017

/

Some hair salon owners worked with their CPA to create an effective low-cost marketing campaign which targeted lapsed and new customers to increase sales. The campaign was traditional but still very effective, another example of how small business CPA advice really can improve growth. About The Client They run a... Read more

Tax Preparation Stress Doesn’t Have to Happen Every Year

Williams Kunkel

/

March 6, 2017

/

Are you stressed about your business taxes and looking for a tax consultant? You are not alone. Tax season stress doesn’t have to be an annual occurrence. Here are some of the causes of the stress and the things you can do to cure your tax preparation stress: MONEY =... Read more

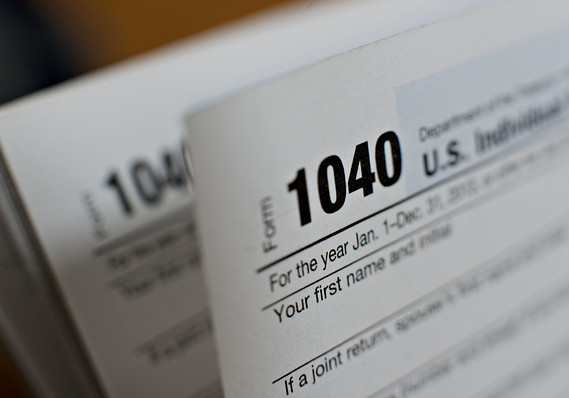

Flower Mound CPA Advice: Is an Extension Right for You?

Williams Kunkel

/

March 21, 2017

/

If you can’t pay your taxes by this year’s April 18th deadline, you can always request a 60- to 120-day extension to pay. Don’t forget about asking your local certified public accountant and tax preparation specialist about the benefits. You may still be charged penalties and interest but at a... Read more

Adding a Banker to Your Small Business Consulting Team

Williams Kunkel

/

March 28, 2017

/

If you want the best for your business, surround yourself with like-minded individuals. As a business owner, get support from a small business consulting team that has expertise in specific areas. Your CPA plays a critical role for you, but don’t forget about others. Cue your business banker. Your CPA... Read more

Deducting Your Car As a Business Expense

Williams Kunkel

/

September 15, 2016

/

,

Whether you’re self-employed or an employee, if you use a car for business, you get the benefit of tax deductions. There are two choices for claiming deductions: Deduct the actual business-related costs of gas, oil, lubrication, repairs, tires, supplies, parking, tolls, drivers’ salaries, and depreciation. Use the standard mileage deduction... Read more

Tax Records: What to Throw, What to Keep

Williams Kunkel

/

September 20, 2016

/

,

Now is a great time to clean out that growing mountain of financial papers and tax documents that clutter your home and office. Here’s what you need to keep and what you can throw out. Let’s start with your “safety zone,” the IRS statute of limitations. This limits the number... Read more

Best of Denton County Runners Up

Williams Kunkel

/

September 23, 2016

/

The Best of Denton County results are in! Williams & Kunkel CPAs were runners up in the Best CPA firm in Denton County for the second year in a row! Best of Denton County is a great way to promote and support local businesses. By voting for a business, you show... Read more

10 Questions to Ask a Tax Preparer Before Hiring

Williams Kunkel

/

February 9, 2016

/

,

The key, as with hiring any professional, is to ask lots of questions. And not just about how much it’s going to cost. Lots questions also apply when hiring a tax preparer. Here’s a list of 10 questions you should ask before hiring a tax preparer: Do you have a... Read more

The Future of the IRS

Williams Kunkel

/

March 3, 2016

/

,

The IRS is developing a “Future State” plan that it says will transform the way the service interacts with taxpayers. Many parts of the plan may ease the processing of filing returns, the issuing of refunds, and the identification and resolution of problems. But the Tax Advocate Service – an independent... Read more

Did You Make a Tax Mistake?

Williams Kunkel

/

April 21, 2016

/

,

The April 18th tax filing deadline is finally in the rearview mirror. Now you might be sitting back, waiting for that refund check to hit your account – or trying not to think about that big one you had to write. Then, all of sudden, you realize you made a... Read more

Year-End Tax Planning Tips

Williams Kunkel

/

November 10, 2015

/

,

Got your year-end tax planning underway for December 31, 2015? WE UNDERSTAND that year-end can be a drudge because it means making sure your business accounts are up to date and in order. But don’t leave it until the last minute. No decision, or rushed decisions, can lead to the... Read more

Six New 2015 Tax Breaks

Williams Kunkel

/

December 22, 2015

/

,

The Protecting Americans from Tax Hikes Act of 2015 is a long-awaited legislation which offers a slate of personal and business tax breaks that had expired at the end of 2014. Here’s a quick summary of how the resurrected breaks can affect your 2015 federal income tax return (Form 1040).... Read more

How Technology Can Make Bookkeeping Easier

Williams Kunkel

/

June 12, 2015

/

,

Four Ways Technology Can Help With Bookkeeping Does it seem like every time you plan to work on your business’s books , you get distracted? Well, if so, you’re not alone. Tackling the books is one of a business owner’s biggest headaches. Luckily, there’s technology that can help any business... Read more

Williams & Kunkel, CPAs LLP client case study TSI

Williams Kunkel

/

February 18, 2015

/

,

,

,

,

,

Bill Beatty at Telephone Services, Inc. talks about his accounting, payroll and more. Bill Beatty was working as VP at Telephone Services, Inc. (TSI) in Lewisville when the business came up for sale in 2005, and he jumped at the chance to own it. After all, how hard could it... Read more