If you are a parent, you can lower your tax burden significantly. Eight different tax credits and deductions are out there that can help lower your tax burden: Dependents In most cases, a child can be claimed as a dependent in the year they were born. Be sure as a parent to state if your family size has increased … Read More

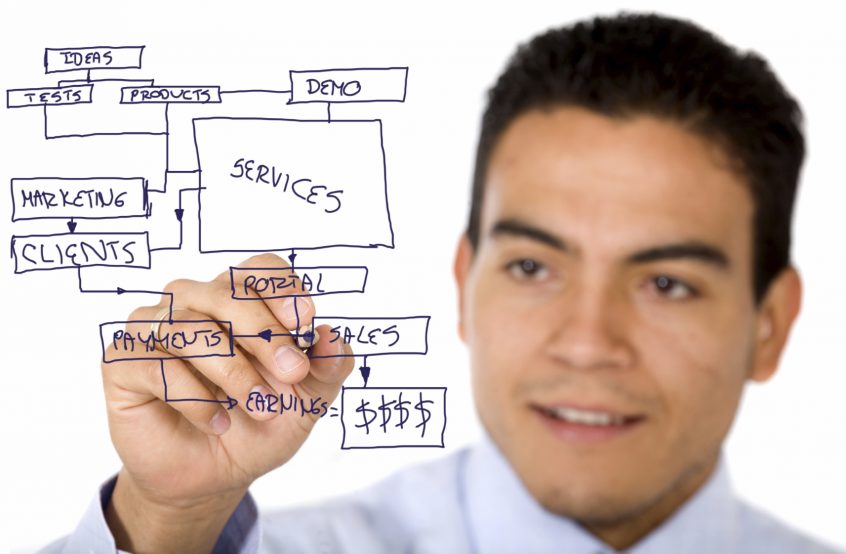

What’s Your Business’s Purpose?

Defining Your Purpose If you don’t know what is is, your customers won’t either. Also, you won’t be able to tell your customers why they should choose you over your competitors. Surely when you decided to start your business you were inspired. Was it to provide a service or product better, faster or cheaper than what was currently available? Was it … Read More

Designer Reaches Goals With CPA’s Help

Dream of A Designer Janet started her interior design business three years ago with a promising vision. The designer planned to work three days a week and help families achieve the home of their dreams by offering her creativity. As happens often with small business owners, the reality didn’t quite pan out as Janet had hoped. Instead of working three … Read More

Check-Up On Your Business’s Health

A body requires routine checks and examinations for its health. So does a business. No matter what stage your business is in, to keep it going you must check its systems, pay attention to any ailments and prevent early death. For the newborn business, the goals and system checks are pretty simple. Merely staying alive and maintaining your sanity is … Read More

Consultant Improves Profit with CPA’s Help

Learning How to Turn Promise into Profit Joe is the CEO of a growing IT consultant firm that provide network management solutions as well as selling and repairing computer equipment out of a retail store. He has two silent partners in the business who lent him some money to get it going. Joe had grown his team to 25 people. … Read More

When To Sell Your Business

When to Sell One of the questions we often ask our clients is “When do you plan to sell your business?” We get all sorts of responses, ranging from “I’ve no intention of selling it” to “We think the boys will take it over, but we’re not sure” to “I’d sell it tomorrow if I could!” Whatever the response, what … Read More

IRS Tips for Hurricane Preparedness

As Hurricane Matthew looms off the Southeastern US coast, the IRS is offering some advice for protecting financial documents and information. In the case of a federally declared disaster, the IRS operates a toll-free number – (866) 562-5227 – staffed by IRS employees specially trained to deal with hurricane disasters. Other tips include: Emergency plan. Have one for homes and … Read More

Money Saving Tips for Couples

1. Rethink date night How often do the two of you have a date night? Some couples have a weekly date night during which they go out to a fancy restaurant, order drinks and then maybe go to a movie or bowling. An evening like that can quickly add up to more than $100. If you want to save money as … Read More