If you’re starting a small business on a fixed budget, you’ve probably spent some time trying to figure out where you can cut costs and do more on your own in order to stretch the funds you have available. One area where you may consider doing it yourself instead of farming it out is accounting. If you have an accounting background … Read More

An Intro to Trump’s Tax Plan

What do you know about president-elect Donald Trump’s tax plan? For starters, he has proposed the largest tax cuts since Ronald Reagan. If Trump were to get everything he has proposed from a Republican-controlled Congress, a taxpayer who makes between $48,000 to $83,000 a year would save about $1,000 under his plan, said Howard Gleckman, a senior fellow at the … Read More

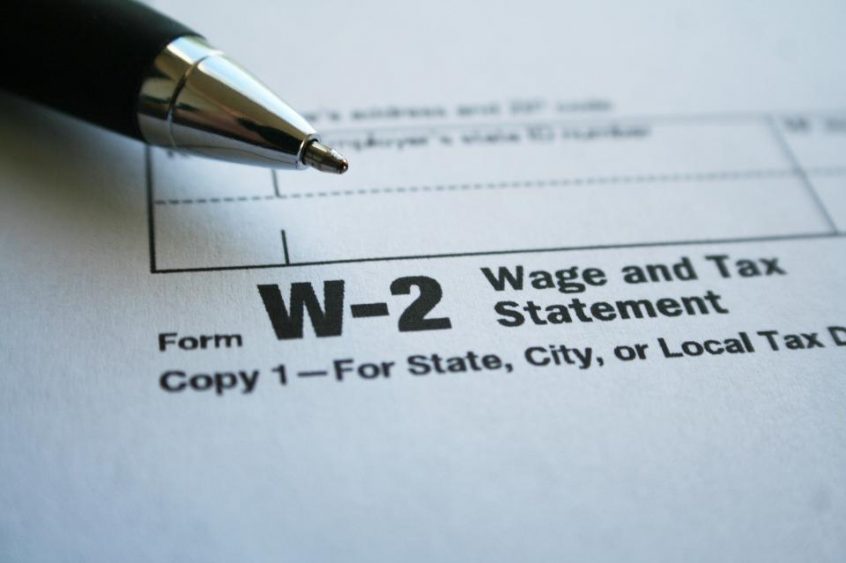

Some IRS Changes for 2017

If you’re a business owner, don’t forget about the date January 31, 2017, the new due date for filing forms W-2. Under a new law, the Protecting Americans from Tax Hikes (PATH) Act, enacted last December, the new filing deadline for employers to submit forms W-2 to the Social Security Administration, is January 31. The new January 31 filing deadline also … Read More