If you want the best for your business, surround yourself with like-minded individuals. As a business owner, get support from a small business consulting team that has expertise in specific areas. Your CPA plays a critical role for you, but don’t forget about others. Cue your business banker. Your CPA can make sure that you have the right systems in … Read More

Flower Mound CPA Advice: Is an Extension Right for You?

If you can’t pay your taxes by this year’s April 18th deadline, you can always request a 60- to 120-day extension to pay. Don’t forget about asking your local certified public accountant and tax preparation specialist about the benefits. You may still be charged penalties and interest but at a lower rate. The IRS also offers installment agreements that allow … Read More

Tax Preparation Stress Doesn’t Have to Happen Every Year

Are you stressed about your business taxes and looking for a tax consultant? You are not alone. Tax season stress doesn’t have to be an annual occurrence. Here are some of the causes of the stress and the things you can do to cure your tax preparation stress: MONEY = STRESS Money is a major source of stress in people’s … Read More

Small Business CPA Advice

Some hair salon owners worked with their CPA to create an effective low-cost marketing campaign which targeted lapsed and new customers to increase sales. The campaign was traditional but still very effective, another example of how small business CPA advice really can improve growth. About The Client They run a small hair salon in New York. After years of running … Read More

How a CPA Can Boost Your Small Business

If you’re starting a small business on a fixed budget, you’ve probably spent some time trying to figure out where you can cut costs and do more on your own in order to stretch the funds you have available. One area where you may consider doing it yourself instead of farming it out is accounting. If you have an accounting background … Read More

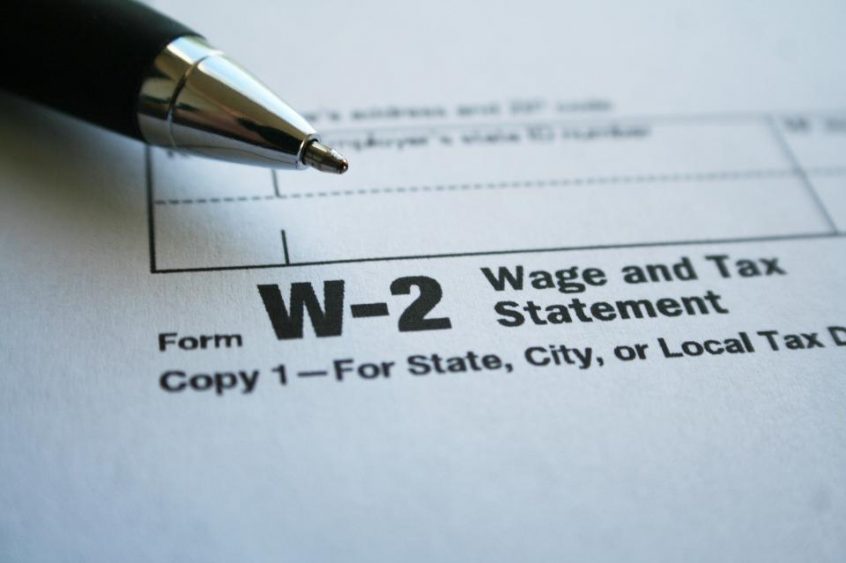

Some IRS Changes for 2017

If you’re a business owner, don’t forget about the date January 31, 2017, the new due date for filing forms W-2. Under a new law, the Protecting Americans from Tax Hikes (PATH) Act, enacted last December, the new filing deadline for employers to submit forms W-2 to the Social Security Administration, is January 31. The new January 31 filing deadline also … Read More

Being a Parent Lowers Your Taxes

If you are a parent, you can lower your tax burden significantly. Eight different tax credits and deductions are out there that can help lower your tax burden: Dependents In most cases, a child can be claimed as a dependent in the year they were born. Be sure as a parent to state if your family size has increased … Read More

Best of Denton County Runners Up

The Best of Denton County results are in! Williams & Kunkel CPAs were runners up in the Best CPA firm in Denton County for the second year in a row! Best of Denton County is a great way to promote and support local businesses. By voting for a business, you show your community how important small businesses are. That’s why we … Read More

Tax Records: What to Throw, What to Keep

Now is a great time to clean out that growing mountain of financial papers and tax documents that clutter your home and office. Here’s what you need to keep and what you can throw out. Let’s start with your “safety zone,” the IRS statute of limitations. This limits the number of years during which the IRS can audit your tax … Read More

Deducting Your Car As a Business Expense

Whether you’re self-employed or an employee, if you use a car for business, you get the benefit of tax deductions. There are two choices for claiming deductions: Deduct the actual business-related costs of gas, oil, lubrication, repairs, tires, supplies, parking, tolls, drivers’ salaries, and depreciation. Use the standard mileage deduction in 2016 and simply multiply 54 cents by the number … Read More